Tribunal rules positively on eligibility of Tax Treaty benefits to fiscally transparent entities

In a recent decision in the case of ING Bewaar Maatschappij I BV (ING BV), as trustees of ING Emerging Market Equity Funds (INGEMEF) v Deputy Commissioner of Income Tax (International Taxation) (Income tax appeal number: 7119/MUM/2014), the Mumbai bench of the Income Tax Appellate Tribunal (ITAT) held that in a situation where all investors / beneficiaries of a tax transparent entity are taxable in the Netherlands, the benefit of India-Netherlands Tax Treaty (Tax Treaty) shall be allowed to the income accrued to such tax transparent entity, assessed in the hands of ING BV, in its representative capacity.

Background

Under Article 13(5) of the Tax Treaty, capital gain derived by a resident of the Netherlands from sale of shares of an Indian company should not be taxable in India unless (a) such shares represent at least 10% interest in the capital stock of the Indian company and (b) sale is made to a resident of India. In this regard, a “resident” of the Netherlands is defined under Article 4 of the Tax Treaty to mean any person who, under the laws of the Netherlands, is liable to tax therein by reason of his domicile, residence, place of management or any other criterion of a similar nature.

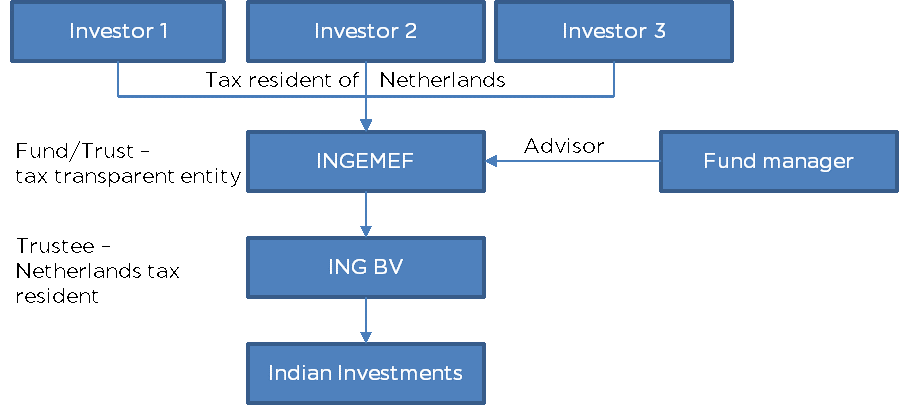

In the instant case, ING BV was a trustee of INGEMEF, established in the Netherlands and registered with Securities Exchange Board of India as a sub-account of ING Assets Management BV, a Foreign Institutional Investor. INGEMEF is a fiscally transparent entity and hence, constituents of INGEMEF are taxable for their respective share of earning.

During the year under consideration, ING BV, in its representative capacity, claimed relief from tax in India under Article 13(5) of the Tax Treaty on the short term capital gain earned by INGEMEF on sale of shares of an Indian company.

Facts of the case

INGEMEF through its trustee / custodian (i.e. in the present case, ING BV) was holding certain shares of Indian companies. During the year under consideration, INGEMEF sold certain shares on which it earned long term as well as short term capital gains. ING BV, in its representative capacity, claimed the long term capital gain to be exempt from taxation in India under the provisions of section 10(38) of the Income Tax Act 1961 (IT Act), whereas short term capital gains was claimed to be not taxable in India under Article 13(5) of the Tax Treaty.

The basis of the position adopted by ING BV was as under:

§ ING BV was a trustee of INGEMEF, which in turn was a fund for joint account set-up in the Netherlands by way of a contractual arrangement.

§ INGEMEF is a tax transparent entity where all its participants are tax residents of the Netherlands.

§ INGEMEF resembles a trust under the IT Act and therefore, the provisions of section 160 to section 164 of the IT Act would be applicable. On this basis, ING BV, as a trustee should be treated as the representative assessee of the participants and hence, income should be taxed in the same manner as in the hands of a beneficiary participant.

§ As all the beneficiary participants are tax residents of the Netherlands and none of them holds 10% or more share of any Indian company, capital gain should not be taxable in India in view of Article 13(5) of the Tax Treaty.

The tax authorities denied the benefit of Tax Treaty on short term capital gain and held that the income has accrued to an ‘Association of Persons' of the INGEMEF and ING BV which is taxable in India basis the following:

§ INGEMEF cannot be equated to a trust and hence, ING BV cannot be treated as a representative assessee of the three participants of INGEMEF.

§ Tax liability of ING BV cannot be assessed on the basis of status of the participants of INGEMEF.

§ Benefit of Article 13 cannot be extended to ING BV, on the basis that INGEMEF is a non-taxable entity in the Netherlands.

§ ING BV’s claim that it is assessable as a representative assessee of INGEMEF for and on behalf of the participants of INGEMEF is without any substance or support of law and no documentary evidence has been furnished to substantiate the said claim.

ITAT Ruling

The ITAT ruled in favour of the Taxpayer based on the following observations:

§ ING BV is a trustee of INGEMEF which is created by way of a contractual arrangement between the investors, fund manager and its custodian. Given that INGEMEF is not a legal entity, it is to be ignored for the purpose of taxability of the income under consideration and thus, the question that needs to be addressed is who the actual beneficiary is, in whose representative capacity ING BV is to be assessed to taxed.

§ As a result of the investments by INGEMEF, income accrues directly to the three participants, who are undisputedly tax residents of the Netherlands and hence the treaty protection cannot be denied.

§ ITAT referred to the co-ordinate bench ruling in the case of Linklaters LLP v Income Tax Officer [2010] 9 ITR (Trib) 217 (Mum), wherein it was held that to decide eligibility to benefits under the Tax Treaty, the fact of income being covered within the tax net of the treaty partner country is relevant and not the manner of taxation.

§ ITAT held that principally, where a taxpayer is the representative assessee of a tax transparent entity, the status of the beneficiaries/constituents of such tax transparent entity is relevant to determine the eligibility to benefits of the Tax Treaty.

§ ITAT placed heavy reliance on the legal position stated in the ruling of Linklaters (supra) and held that so long as the income is liable to tax in the Netherlands, whether in the hands of ING BV or in the hands of constituents of INGEMEF, the benefit under the Tax Treaty cannot be denied.

§ In the present fact scenario, income has actually accrued to the investors, which are taxable entities in the Netherlands, and hence, the benefit under the Tax Treaty has to be allowed on the income taxed in the hands of ING BV, in its representative capacity. Thus, in accordance with Article 13(5) of the Tax Treaty, the short term capital gain shall not be taxable in India.

Comments

The issue of a fiscally transparent entity being eligible to the benefits of a tax treaty has been a matter of judicial debate in India for a number of years, with their being no finality on India’s position. While Article 4 of the Tax Treaty strictly covers any person who, under the domestic tax laws of the Netherlands, is liable to tax therein by reason of his domicile, residence, place of management or any other criterion of similar nature, the ruling of ITAT appears to imply that this definition is not sacrosanct and where the income per se is taxed in the Netherlands (irrespective of the manner in which it is taxed), the benefit under the Tax Treaty should be allowed on such income.

It may be noted that while the Organisation for Economic Co-operation and Development (OECD) Commentary supports the view that a pass-through entity can look through to its investors for purposes of applying the respective treaty benefits, India (which is not a member of the OECD) has not agreed to this by clarifying its position that tax treaty benefit should be allowed only where the income is derived by a person which is a resident of the treaty partner jurisdiction. It is interesting to note that recently India has again stated its reservation on applicability of treaty benefits on a pass-through basis in the discussions on Base Erosion and Profit Shifting. Given the divergent judicial views and India’s position on the residency provisions under the Tax Treaty, the issue continues to be in speculation, and it would be helpful for India to clarify its position by way of an administrative circular.

- Bijal Ajinkya (Partner) and Rahul Jain (Senior Associate)

We have updated our Privacy Policy, which provides details of how we process your personal data and apply security measures. We will continue to communicate with you based on the information available with us. You may choose to unsubscribe from our communications at any time by clicking here.

For private circulation only

The contents of this email are for informational purposes only and for the reader’s personal non-commercial use. The views expressed are not the professional views of Khaitan & Co and do not constitute legal advice. The contents are intended, but not guaranteed, to be correct, complete, or up to date. Khaitan & Co disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident or any other cause.

© 2024 Khaitan & Co. All rights reserved.

Mumbai

One World Centre

10th, 13th & 14th Floor, Tower 1C

841 Senapati Bapat Marg

Mumbai 400 013, India

Mumbai

One Forbes

3rd & 4th Floors, No. 1

Dr. V. B. Gandhi Marg

Fort, Mumbai 400 001

Delhi NCR (New Delhi)

Ashoka Estate

11th Floor, 1105 & 1106,

24 Barakhamba Road,

New Delhi 110 001, India

Kolkata

Emerald House

1B Old Post Office Street

Kolkata 700 001, India

Bengaluru

Embassy Quest

3rd Floor

45/1 Magrath Road

Bengaluru 560 025, India

Delhi NCR (Noida)

Max Towers,

7th & 8th Floors,

Sector 16B, Noida

Uttar Pradesh 201 301, India

Chennai

8th Floor,

Briley One No.30

Ethiraj Salai

Egmore

Chennai 600 008, India

Singapore

Singapore Land Tower

50 Raffles Place, #34-02A

Singapore 048623

Pune

Raheja Woods

03-108-111, 3 Floor

8, Central Avenue, Kalyani Nagar

Pune - 411 006, India

Gurugram (Satellite Office)

Suite No. 660

Level 6, Wing B,

Two Horizon Center

Golf Course Road, DLF 5

Sector 43, Gurugram

Haryana 122 002, India

Ahmedabad

1506 - 1508, B-Blockr

Navratna Corporate Parkr

Iscon Ambli Road, Ahmedabadr

Gujarat - 380058